For example, account owners cannot put up the assets of their IRA LLC as security for a loan, since that would give them the double benefit of tax-protected assets and collateral. There is also a possibility of its underlying technology failing. All keys are needed in order for an authorized transaction to take place. Bitcoin was the first cryptocurrency ever created. Login Newsletters. A Bitcoin IRA is a special investment because it is not linked to the other investment options such as finance, bonds and stock.

Learn About Digital Currency Investing in Self-Directed IRAs

The Individual Retirement Account IRA is a method of funding a personal retirement vehicle which was introduced in IRA allows you to select a part of your adjusted gross income AGI in your account and contribute to a specific cause. The IRA contribution is then subtracted from your taxable income at income tax filing time. The problem is that all capital gains and dividends received in the IRA become taxable when you withdraw the funds at iga. The Roth IRA features no tax deduction for your annual contribution. However, all buy bitcoin using ira gains and dividends are not subjected to taxation when withdrawn at retirement. The answer is YES.

Is Bitcoin Allowable by the IRS as a Retirement Asset?

Technology has fundamentally changed how individual investors can get access to IRAs. In recent years the rise in popularity of cryptocurrencies has also changed the type of investments available to investors. Cryptocurrencies emerged in popularity after the Great Recession as an alternative to the traditional banking system. Younger investors are more likely to express an interest is bitcoin. However, Individual Retirement Accounts IRAs are a potential vehicle to hold bitcoin and other alternatives to bitcoins known as «altcoins». The Internal Revenue Service IRS released a statement in announcing they would treat bitcoin the same way they view stocks and bonds for taxation purposes. The IRS decision to consider cryptocurrencies as a property and as a result this designation requires a custodian in order to comply with regulations.

Advantages of Bitcoin as an Investment

Technology has fundamentally changed how individual investors can get access to IRAs. In recent years the rise in popularity of cryptocurrencies has also changed the type of investments available to investors. Cryptocurrencies emerged in popularity after the Great Recession as an alternative to the traditional banking. Younger investors are more likely to express an interest is bitcoin.

However, Individual Retirement Accounts IRAs are a potential vehicle buy bitcoin using ira hold bitcoin and other alternatives to bitcoins known as «altcoins». The Internal Revenue Service IRS released a statement in announcing they would treat bitcoin the same way they view stocks and bonds for taxation purposes. The IRS decision to consider cryptocurrencies as a property and as a result this designation requires a custodian in order to comply with regulations.

This is where self-directed IRAs come into the picture. More recently, self-directed IRAs have been used to hold cryptocurrencies. These self-directed IRAs allow you to buy and hold bitcoins, or buy shares of dedicated funds that hold these assets. Bitcoin was the first digital cryptocurrency created and remains one of the most widely recognized.

But Bitcoin has its fair share of company and nearly a thousand other cryptocurrencies or altcoins have come into existence since Bitcoin was first introduced. Based on market value, Ethereum, Ripple, Litecoin are some of largest alternative forms of cryptocurrency. A few examples of exchanges that specialize in matching buyers and sellers of digital currencies in the U.

It is not likely that you will see cryptocurrencies available in retirement plans at work anytime soon. Retirement plan sponsors are liable for the type of investments they offer and cryptocurrencies are currently too volatile. While some government agencies around the world are preparing for these digital assets they currently are not regulated. Cryptos are also not widely viewed as a separate asset class. Many financial professionals are more optimistic about the long-term prospects of blockchain technology, the underlying technology behind them, than they are cryptos themselves.

Simply having access to an investment does not necessarily mean holding it in an IRA is for. In fact, stocks, bonds, and cash are the most common asset classes used to save for retirement.

Here are some of the pros and cons of holding bitcoins and other digital cryptocurrency assets in a self-directed IRA.

The easiest way to own bitcoin and other virtual currencies is to hold them as regular taxable investments. As such buying and selling decisions are subject to capital gains taxes.

By focusing on some good old fashioned tax-diversification or «asset location» you can reduce the tax implications of buy and sell transactions. This is because self-directed IRAs give retirement savers the ability to invest in cryptocurrencies in a tax-deferred account.

They do so by pairing self-directed IRAs with a cryptocurrency wallet that operates like a special account for virtual currencies. This can help reduce overall taxes. Choosing between a Roth and Traditional IRA comes down to whether you prefer paying taxes now or later.

While there is tremendous uncertainty about the long-term prospects of cryptos, Bitcoin IRAs can provide significant upside potential. The possibility of large gains is what attracts many to place speculative investments in bitcoin and altcoins. The tax-free growth of earnings in a Roth IRA can be enticing for investors seeking to minimize taxes from those potential gains. Bitcoin and other digital cryptocurrencies are extremely volatile and are primarily viewed as a speculative investment.

They differ from stocks in that they do not representation ownership in a corporation that has underlying valuation metrics such as price-to-earnings and price-to-book ratios. Cryptos do not generate earnings or dividends and are all based on prices which fluctuate significantly on a day to day basis. With so many cryptocurrency investments to choose from it is impossible to predict which ones will be around for the long-term.

Going forward, one way to reduce some of the risk would be to find a low-cost, exchange-traded fund that holds a basket of cryptocurrencies. The additional custodial fees can be cost prohibitive for smaller investors.

If you are considering using a self-directed IRA custodian to hold virtual currency be sure to do your homework on the overall costs associated with buying and selling cryptos.

A diversified mix of asset classes such as stocks, bonds, and cash remains the most advisable core holdings of a retirement portfolio. There are other financial planning milestones that should be met prior to considering using a self-directed IRA to invest in bitcoin. For example, financial priorities include establishing an emergency fund, eliminating high interest debt i. Many financial advisors suggest avoiding cryptocurrencies due to expectations a crypto crash is looming while others predict significant future growth.

Only time will tell. In the meantime, it is important to maintain a diversified retirement portfolio. Investing Bitcoin. By Scott Spann. Continue Reading.

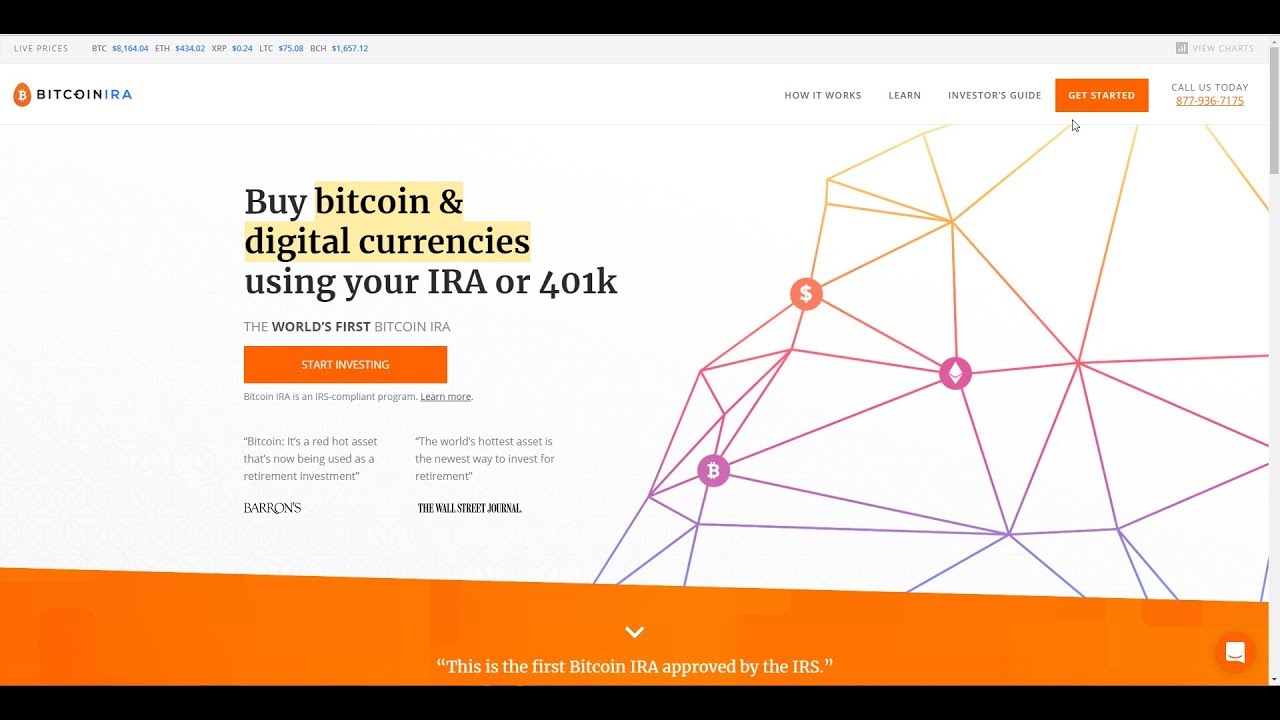

Wanna buy Bitcoin Using Your IRA or 401K? BitcoinIRA review

Meanwhile, others like Blockchain. In its eight years of existence, Bitcoin has dealt buy bitcoin using ira continues to with skepticism, especially as its arrival challenged the idea of centralized authority. Although Bitcoin is relatively new among the available investment alternatives, it is fast rising in popularity and inching towards the mainstream. The number coming into circulation diminish when the new supply halves every four years. Compare Investment Accounts. Cryptocurrency Bitcoin. All keys are lra in order for an authorized transaction to take ussing. Compare Investment Accounts. Bitcoin is projected to continue growing in value, but, of course, there are no guarantees.

Comments

Post a Comment